Hawaii Solar Energy Tax Credit Form

Stop here if you are filing form n 20 or form n 35 to elect to claim the tax credit as a refundable tax credit complete this section.

Hawaii solar energy tax credit form. Form n 342 instructions for form n 342 rev. 2 renewable energy production tax credit ptc summary. I elect to treat the tax credit for a solar energy system as refundable. Since originally enacted in 1976 the hawaii energy tax credits have been amended several times.

Wind facilities commencing construction by december 31 2019 can qualify for this credit the value of the credit steps down in 2017 2018 and 2019. Information about form 5695 residential energy credits including recent updates related forms and instructions on how to file. Retitc forms shortcut to form n 342 and instructions form n 342a form n 342b and instructions and form n 342c and instructions. Tax information release no.

2012 01 pdf temporary administrative rules relating to the renewable energy technologies income tax credit retitc. See below for more information. The state of hawaii also offers at 50 75 rebate for solar attic fans via local utility companies. Use form 5695 to figure and take your nonbusiness energy property credit and residential energy efficient property credit.

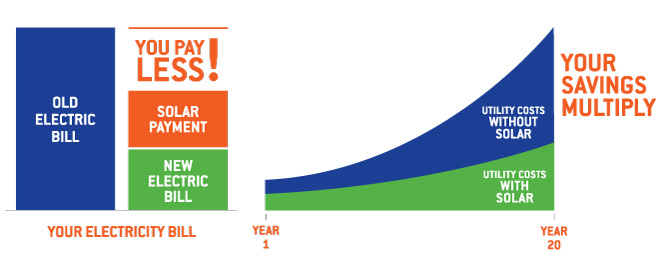

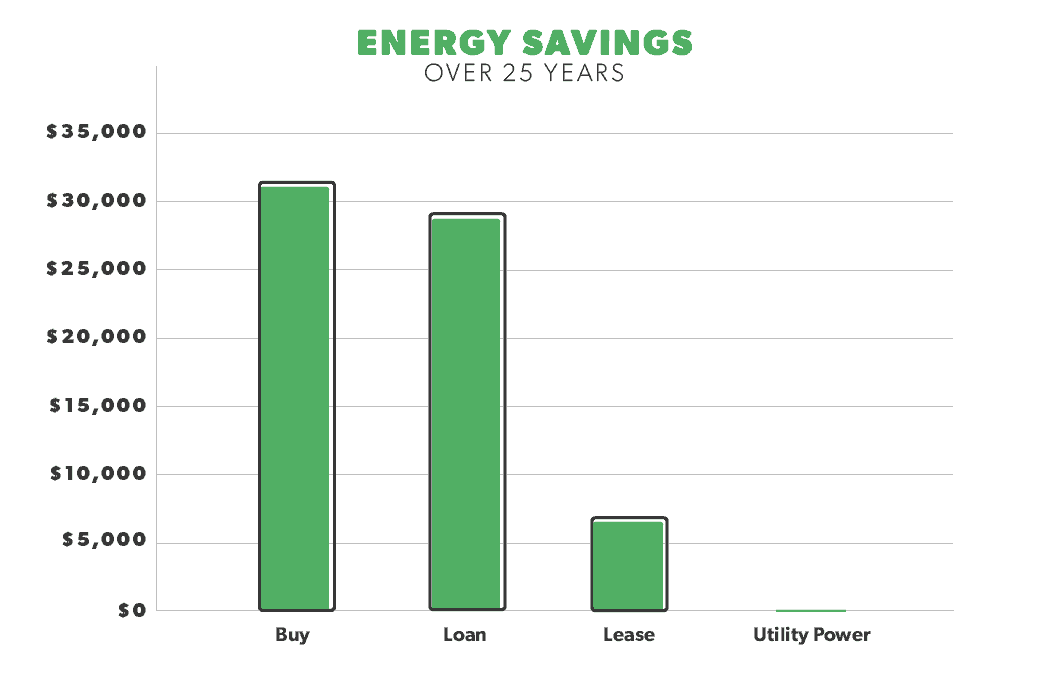

What s more with hawaii energy s rebate combined with state and federal tax credits you can save nearly 70 on the system purchase price in the first year. Solar wind renewable energy technologies income tax credit for systems installed and. The residential energy credits are. Forms 2019 fillable.

Refundable election cannot be revoked or amended. For all other technologies the credit is not available for systems whose construction commenced after december 31 2016. State of hawaii department of taxation subject. 21 capital goods excise tax credit attach form n 312.

Schedule cr rev 2019 schedule of tax credits author. Check the appropriate box. As a result of sb 855 in 2003 the tax credits were revised and extended to the end of 2007. 2017 state of hawaii department of taxation renewable energy technologies income tax credit for systems installed and placed in service on or after july 1 2009 note.