Government Rebate For Solar Panels 2017

Federal income tax credits and other incentives for energy efficiency.

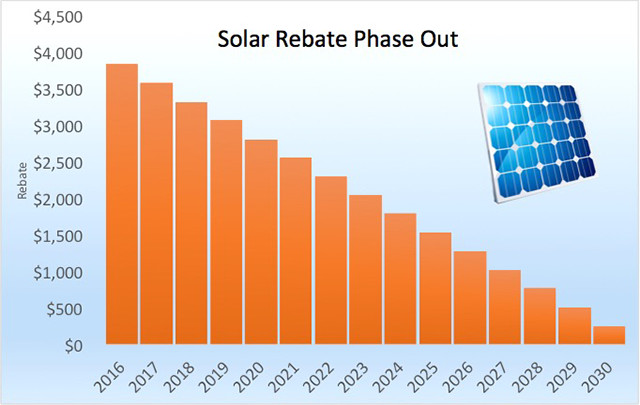

Government rebate for solar panels 2017. Tax credits for residential energy efficiency have now been extended retroactively through december 31 2020. Eligible households can claim a discount on the cost of a solar panel pv system up to a maximum rebate of 1 850. The roadmap is designed to be rolled out in safe steady and sustainable steps. The rebate will reduce by one fifteenth of its current amount on the first day of each new year until 2030 and will end on the 31 st of december that year.

The victorian government has announced victoria s roadmap for reopening. To further reduce installation costs householders can apply for an interest free loan for an amount equivalent to their rebate amount. The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020. Filing requirements for solar credits.

Solar panel pv rebate. Covid 19 household utility relief electricity and gas rebates electricity asset ownership dividend interest free loans for solar and storage electricity and reticulated natural gas rebates home energy emergency assistance scheme solar for rentals trial. The solar panel rebate that we are not allowed to call a rebate reducing the upfront cost of solar power systems in australia if you buy a solar system today july 2020 it is subsidised by a federal government scheme worth about 585 per kw installed based on a 39 stc price i explain this later. Home tax credits rebates savings please visit the database of state incentives for renewables efficiency website dsire for the latest state and federal incentives and rebates.

Other incentives for solar accelerated depreciation. At the start of 2017 the rebate of 3 990 that most. Households and small businesses across australia that install a small scale renewable energy system solar wind or hydro or eligible hot water system may be able to receive a benefit under the small scale renewable energy scheme sres to help with the purchase cost. You calculate the credit on the form and then enter the result on your 1040.

To claim the credit you must file irs form 5695 as part of your tax return. Thanks to accelerated depreciation businesses can write off the value of their solar energy system through the modified accelerated cost recovery system macrs which reduces businesses tax burden and accelerates returns on solar investments qualified solar energy equipment is eligible for a cost recovery period of five years.