Federal Investment Tax Credit For Commercial Solar Energy Property

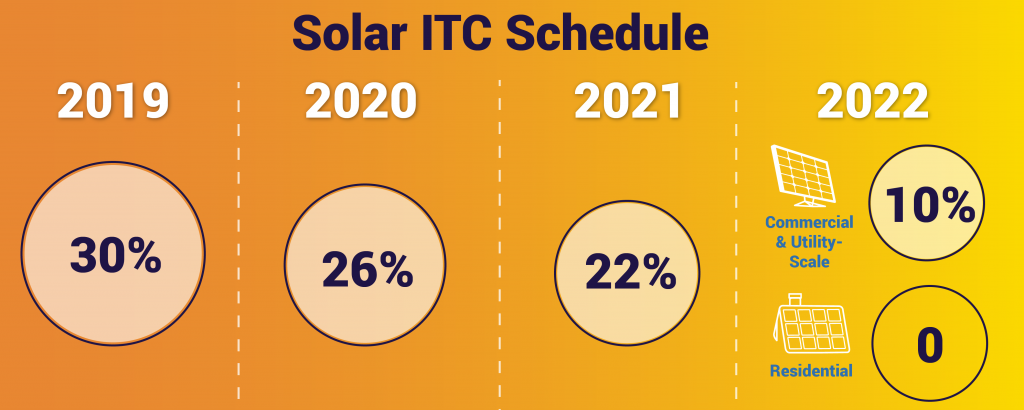

The solar investment tax credit itc is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic pv system that is placed in service during the tax year 1 other types of renewable energy are also eligible for the itc but are beyond the scope of this guidance to be eligible for.

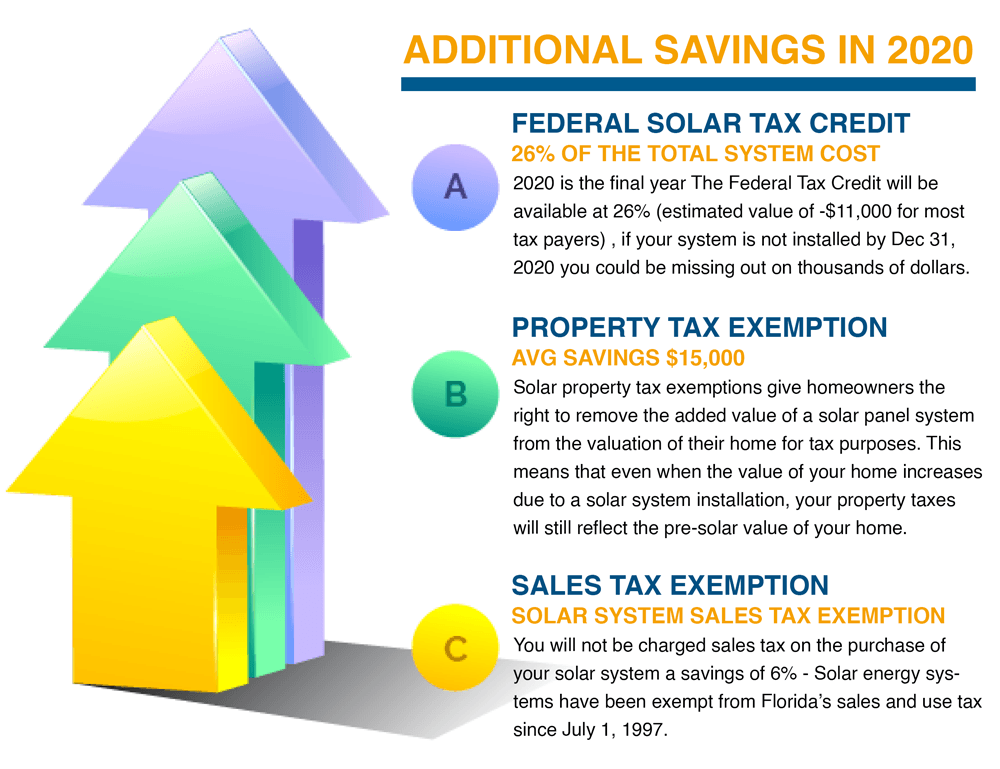

Federal investment tax credit for commercial solar energy property. These two guides one for homeowners and one on the commercial itc provide a concise yet thorough overview of the itc demystifying the tax code with intuitive explanations and examples answering frequently asked questions and explaining the process of claiming the itc. The federal solar tax credit also known as the investment tax credit itc is one of the best financial incentives for solar in the united states it allows you to deduct 26 percent of the cost of a solar energy system from your federal taxes and there s no cap on its value. Qualifying advanced energy project. Claiming a 1 000 federal tax credit reduces your federal income taxes due by 1 000 1 what is the federal solar tax credit.

Solar industry has grown by more than 10 000 creating hundreds of thousands of jobs and investing billions of dollars in the u s. The investment credit consists of the following credits. Rehabilitation energy qualifying advanced coal project qualifying gasification project and. If you install solar energy for your commercial property there are solar tax credits available.

Solar tax credits were made available by the federal government in 2016 and extend until 2021. Economy in the. The itc applies to both residential and commercial systems and there is no cap on its value. The federal residential solar energy credit is a tax credit that can be claimed on federal income taxes for a percentage of the cost of a solar photovoltaic pv system 2 other types of renewable energy are also.

The solar investment tax credit itc is one of the most important federal policy mechanisms to support the growth of solar energy in the united states. The federal solar tax credit also known as the investment tax credit itc allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.